New Consumer Engagement Trends Validate the D2C Opportunity for Brands

Registria's report offers insights into the ownership experience including consumer preference for mobile as the onboarding method DENVER, CO (June...

OUR SOLUTIONS

OUR TECHNOLOGY

3 min read

Chris McDonald : Oct 24, 2019 4:40:45 PM

The series explores the extended warranty and service market and the new trends brought to light by Registria's newest owner research.

A leading product brand and a well-known retailer recently announced that the majority of their profit now comes from services. Is anyone surprised?

At the recent Warranty Innovations Conference, we shared some eye-opening trends, research, and financial metrics on the need for the often maligned "extended warranty" to evolve into a far more strategic services strategy anchored in care. More specifically I shared how product brands leading the pivot are skillfully layering in subscription-based service offerings for more predictable recurring revenue. This strategic move shifts brands focus from a transactional mindset with their owners, designed to maximize profit on one extended warranty sale, to a loyalty mindset that delivers far more margin over time as product and service sales recur at a higher rate throughout the customer's entire ownership experience.

The iconic product brand I referred to above is Apple, which is realizing $11B/quarter, double-digit growth and 60%+ margins from services. The retailer is Best Buy, which is working to transform itself into a support service provider. For a subscription price of $200 per year, Best Buy’s “Total Tech Support” offers customers unlimited phone, online and in-store support on technical tasks such as removing viruses or setting up a home network. Services now makes up 60% of Best Buy’s profit margin.

Why are they pivoting? Twenty years ago, authors Joseph Pine and James Gilmore (“The Experience Economy”) proposed that we were entering a new era where brands will compete for customers by offering memorable experiences and not just goods and services. They were right, and the experience economy continues to shape the way brands are evolving their offerings to attract new sales and promote long-term value.

“Businesses must orchestrate memorable events for their customers, and that memory itself becomes the product.” - Joseph Pine & James Gilmore, The Experience Economy

Leaders, like Apple, have paved the way for pivoting from products to services. While the iPhone is a physical product, consumers now pay for it – and its supporting ecosystem – through subscriptions. This not only gives Apple more control over the consumer’s experience, it opens up the door to expanding that experience with an ever-growing list of services, such as Apple’s new content streaming platform announced last month. The monthly recurring revenue realized through the subscription model also gives the company a tether during unpredictable or recessive economic times when consumers are buying less goods.

Here’s another interesting example – Volvo, which is now offering an alternative to buying and financing a new model all up front. Instead, customers can purchase a 36-month subscription. Sounds like a leasing model, until you realize that the $600/month “subscription” includes insurance, a maintenance plan, and the option to upgrade to a new model in 12 months. See where this is going?

It begs the question…what do today’s consumers want from the brands they buy from?

Let me start by sharing what consumers say they don’t want. Registria recently completed a survey of consumers who registered a product during a six-month period in 2019. Eighty-two percent of them said they did not purchase a service plan. Not from the retailer, not from the brand. Why? Less than 10% said it was too expensive or that they didn’t know it was an option. However, the majority said that they never buy extended warranties or that the manufacturer’s warranty was enough. The key takeaway here is that for the majority of consumers, the offer of an extended warranty or service plan is not valuable enough to purchase.

Let’s go back to that Volvo example. Their new subscription program, “Care by Volvo,” is having strong early success at converting first-time customers and conquest buyers (those who own vehicles from other brands). More than 95% of Care by Volvo subscribers are new to the Volvo brand.

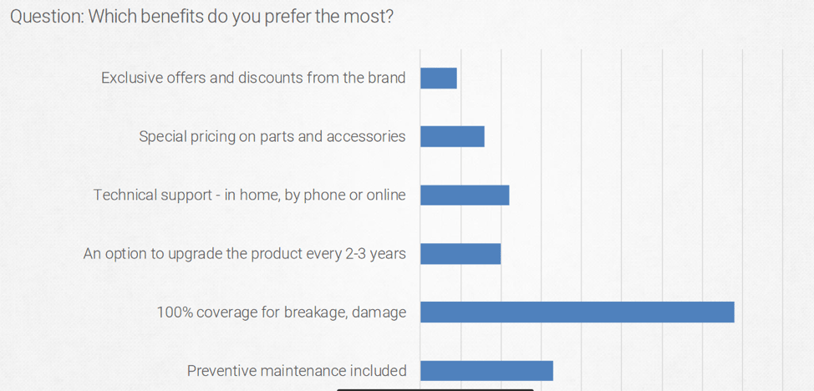

When we asked respondents to our survey, we uncovered a variety of aftermarket benefits that consumers value.

Note that many of these benefits are actually brand-oriented, which underlies the desire of customers to find affinity with and give loyalty to their favorite brands.

Our research also showed that nearly two-thirds of respondents would prefer to buy aftermarket plans from the brand and not the retailer. And they would buy from the brand if the brand offered more benefits and if the price of coverage was reasonable.

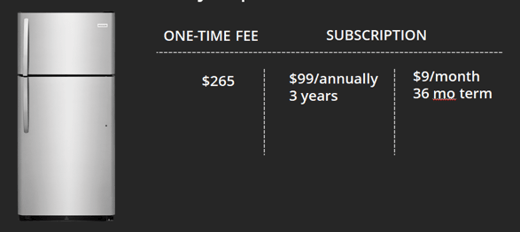

Here’s one key additional finding from the survey. We asked:

“If you were to purchase a new refrigerator for $2,500, which service plan payment option would you prefer over a 3-year period?”

Interestingly, 33% of the owners who purchased a service plan stated they would prefer to purchase a subscription plan – even when shown that the total cost of ownership was higher over three years.

So what do product brands need to do differently to thrive in the experience economy?

First, let’s consider that either the extended warranty is dead -- or it’s taking on new significance by becoming a cornerstone of the overall ownership experience. I’ll place my bets that the product brands that thrive for the long-term will strategically adjust their approach in this area– and the sooner, the better. Here’s what they can do:

Recognize that consumers value aftermarket care – and are willing to pay a premium for it – but they want more than a simple warranty product

Think outside the warranty to create value-added services for customers as part of an exceptional ownership experience

Use the recurring revenue from these new service offerings to help sustain the brand through product release cycles and uncertain economic times

Registria's report offers insights into the ownership experience including consumer preference for mobile as the onboarding method DENVER, CO (June...

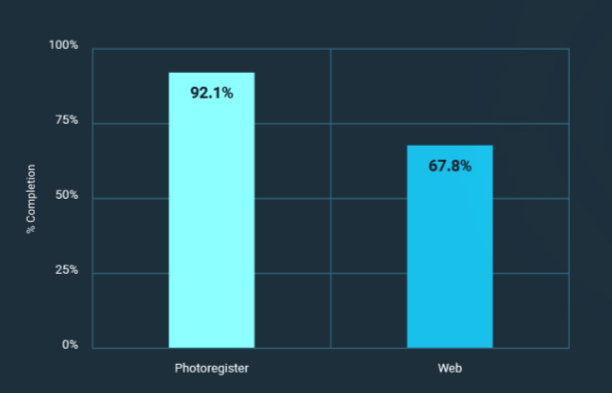

An important set of Key Performance Indicators (KPIs) have emerged as brands transform their owner onboarding approach from a transactional product...

1 min read

To say that the term “customer experience” is ubiquitous is like saying there are quite a few stars in the galaxy. A simple Google search returns two...